What is the Payment Gateway?

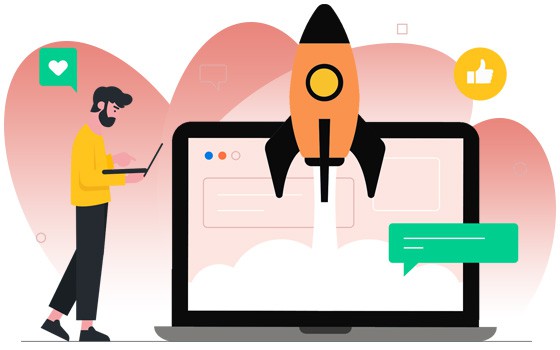

A payment gateway is a software application that enables the secure transfer of credit card information from a website to the credit card payment network for e-commerce payment processing. Then it returns transaction details and responses from the payment network back to the website.

Although online transactions appear to be quick and straightforward on the plain surface, in reality, a number of processes work together at the backend to move funds seamlessly and securely from buyer to seller.

Why do you need a payment gateway?

Payment gateway is a medium that helps merchants collect payments from customers without hassles. It’s a transaction type wherein your customer can make payments directly through the payment gateway. All they have to do is add the card details and save them for future reference.

And it works for the customer as any transaction requires password/ OTP verification to ensure safety. So making payments through an online payment gateway becomes convenient and easy.

Payment gateway services protect customer’s payment details and help avoid breaches of data. And further eliminating the risk of exposing your business to fraud or additional charges. Apart from that, it also protects merchants while collecting payments as accounts with insufficient funds or exceeding credit limits will not be able to move ahead with the transaction.

Online payment will continue to play an ever-growing and significant role in the development of e-commerce as well as the stimulation of consumer demand..

The Javelin Strategy & Research, 2018 monitored and evaluated the consumers’ payment preferences, which indicates the need to integrate an e-commerce payment system to any online site.

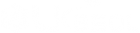

How does an eCommerce Payment Gateway Work?

The motto behind payment gateways is to make payment processing effective, secure, and hassle-free. Instead of transmitting payments, the payment gateway approves the funds that are transferred to the seller, and do as such in a safe and secure way for the buyer..

Payment gateways even observe PCI compliance standards, introducing myriad security techniques as expected, to prevent fraud. Below are the steps showing how payment gateway for eCommerce works.

Step 1: The process starts as soon as a customer places an order on an eCommerce website and fills their credit card essentials.

Step 2: The web browser encodes the data to be sent between it and the merchants’ web server.

Step 3: Next, the gateway sends the transaction data to the payment processor used by the merchants acquiring bank.

Step 4: The payment processor sends the transaction data to a card affiliation.

Step 5: The credit cards’ issuing bank sees the approval request and “approves” or “denies.”

Step 6: The processor then forwards an approval related to the merchant and customer to the gateway.

Step 7: Once the gateway acquires this reaction, it transmits it to the site/interface to process the payment.

Step 8: ‘Clearing Transactions’ is activated once the merchant has completed the transaction.

Step 9: The issuing bank changes the “auth-hold” to a debit, permitting a “settlement” with the vendors’ securing bank.